It’s safe to conclude that car insurance companies don’t want policyholders to shop around. Consumers who shop around for the cheapest price are likely to switch companies because there is a high probability of finding a lower-cost company. A recent survey revealed that people who did price comparisons regularly saved on average $865 a year compared to policyholders who don’t make a habit of comparing rates.

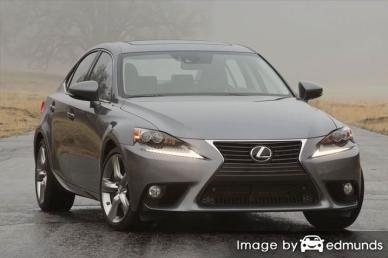

If finding the lowest price on Lexus IS 350 insurance is why you’re reading this, understanding how to quote and compare insurance coverage can make it easier to shop your coverage around.

If your goal is the lowest price, then the best way to quote cheaper Lexus IS 350 insurance in Charlotte is to start doing an annual price comparison from companies who sell insurance in North Carolina.

If your goal is the lowest price, then the best way to quote cheaper Lexus IS 350 insurance in Charlotte is to start doing an annual price comparison from companies who sell insurance in North Carolina.

First, try to learn about policy coverages and the measures you can take to prevent expensive coverage. Many risk factors that cause rate increases like traffic tickets, fender benders, and poor credit history can be amended by making lifestyle changes or driving safer.

Second, compare prices from direct carriers, independent agents, and exclusive agents. Direct and exclusive agents can only give prices from one company like GEICO or Farmers Insurance, while independent agencies can quote rates for a wide range of insurance providers.

Third, compare the new rate quotes to your current policy and see if you can save money. If you can save money, make sure there is no lapse in coverage.

Fourth, give notification to your agent or company to cancel your current auto insurance policy and submit a completed application and payment to the new company. Make sure you put the new certificate verifying coverage in a readily accessible location in your vehicle.

The key thing to remember is to try to compare similar limits and deductibles on every price quote and and to get price estimates from all possible companies. Doing this provides a fair rate comparison and and a good selection of different prices.

Locating the most cost-effective insurance policy in Charlotte is easy if you know what you’re doing. If you have insurance now, you stand a good chance to be able to get lower rates using these methods. But North Carolina drivers must understand the way companies compete online and use it to find better rates.

It’s important to know that comparing a wide range of rates increases your odds of finding better pricing.

The following companies are our best choices to provide quotes in North Carolina. If multiple companies are listed, we suggest you compare several of them to get the lowest price.

Rates and statistics

The table shown next covers estimates of insurance prices for Lexus IS 350 models. Being aware of how insurance prices are formulated can assist in making smart choices when comparing insurance quotes.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| IS 350 4-Dr Sedan | $234 | $432 | $254 | $16 | $76 | $1,012 | $84 |

| IS 350 C 2-Dr Convertible | $234 | $432 | $254 | $16 | $76 | $1,012 | $84 |

| Get Your Own Custom Quote Go | |||||||

Above prices assume married female driver age 30, no speeding tickets, no at-fault accidents, $250 deductibles, and North Carolina minimum liability limits. Discounts applied include claim-free, multi-policy, homeowner, safe-driver, and multi-vehicle. Prices do not factor in specific garaging location which can affect insurance rates considerably.

Accidents and violations increase rates

The diagram below shows how speeding tickets and at-fault fender-benders raise Lexus IS 350 auto insurance rates for different insured age categories. The price estimates are based on a single male driver, comprehensive and collision coverage, $100 deductibles, and no additional discounts are factored in.

Full coverage rates compared to liability-only

The chart below visualizes the comparison of Lexus IS 350 car insurance costs when comparing full coverage to liability only. The data is based on no accidents or driving violations, $500 deductibles, single marital status, and no policy discounts are applied.

When to stop buying comprehensive and collision coverage

There is no specific rule to stop paying for physical damage coverage, but there is a broad guideline. If the yearly cost of full coverage is more than around 10% of the vehicle’s replacement cost less your deductible, then it could be time to drop full coverage.

For example, let’s pretend your Lexus IS 350 replacement cost is $9,000 and you have $1,000 policy deductibles. If your vehicle is destroyed, the most you would receive is $8,000 after paying the physical damage deductible. If you are currently paying more than $800 annually for your policy with full coverage, then it could be time to drop full coverage.

There are some scenarios where removing full coverage is not a good plan. If you still have a lienholder on your title, you are required to maintain full coverage in order to prevent your loan from defaulting. Also, if your finances do not allow you to purchase a different vehicle if your current one is totaled, you should maintain full coverage.

Why you need quality insurance for your Lexus vehicle

Despite the fact that car insurance is not cheap in Charlotte, paying for car insurance serves a purpose in several ways.

First, just about all states have compulsory liability insurance requirements which means you are required to carry a specific minimum amount of liability protection if you don’t want to risk a ticket. In North Carolina these limits are 30/60/25 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

Second, if your IS 350 has a lienholder, it’s most likely the lender will make it mandatory that you carry insurance to guarantee payment of the loan. If you cancel or allow the policy to lapse, the lender may have to buy a policy to insure your Lexus at an extremely high rate and require you to pay much more than you were paying before.

Third, insurance safeguards not only your Lexus but also your assets. It will also reimburse you for medical transport and hospital expenses for you, any passengers, and anyone injured in an accident. Liability insurance also pays for attorney fees and expenses if you cause an accident and are sued. If damage is caused by hail or an accident, collision and comprehensive (also known as other-than-collision) coverage will pay to restore your vehicle to like-new condition.

The benefits of buying enough insurance outweigh the cost, especially with large liability claims. Despite what companies tell you, the average driver is currently overpaying as much as $800 each year so smart consumers compare quotes at every policy renewal to help ensure money is not being wasted.

What Determines Lexus IS 350 Insurance Costs?

Many things are used in the calculation when you get your auto insurance bill. Some of the criteria are obvious such as traffic violations, but other criteria are more transparent such as your marital status or how safe your car is.

The list below includes some of the most common factors that factor into your rates.

- Costs are affected by your address – Having an address in smaller towns and rural areas of the country can save you money if you are looking for the lowest rates. Less people means reduced accidents. Drivers in populated North Carolina areas have to deal with more auto accidents and more severe claims. More time on the road means higher likelihood of an accident.

- How much liability coverage do you need? – The liability coverage on your policy will protect you in the event that a court rules you are at fault for personal injury or accident damage. Liability insurance provides for a legal defense starting from day one. This coverage is very inexpensive compared to comp and collision, so do not cut corners here.

-

Is your car, truck or SUV built for speed? – The make and model of the car you are trying to find cheaper insurance for makes a huge difference in determining your rates. The lowest premiums are usually for small economy passenger cars, but the final cost of insurance is determined by many other factors.

The chart below uses these assumptions: single male driver age 50, full coverage with $250 deductibles, and no discounts or violations. It shows Lexus IS 350 insurance rates compared to other vehicles that have different performances.

-

Cheaper to insure gals? – Over the last 50 years, statistics have shown that women are safer drivers than men. However, this does not mean males are worse at driving than females. Both genders are responsible for auto accidents at about the same rate, but males have costlier accidents. They also receive more costly citations like DWI (DUI) or reckless driving.

The illustration below shows the comparison of Lexus IS 350 auto insurance costs for male and female drivers. The premium estimates are based on no violations or accidents, comp and collision included, $250 deductibles, single marital status, and no additional discounts are factored in.

-

Lexus IS 350 insurance loss probability – Insurers analyze historical claim data in order to profitably underwrite each model. Models that the data shows to have increased losses will have increased rates. The table below demonstrates the historical insurance loss data for Lexus IS 350 vehicles.

For each type of coverage, the statistical loss for all vehicles averaged together is set at 100. Numbers below 100 indicate better than average losses, while values over 100 indicate a higher chance of having a claim or statistically larger losses.

Lexus IS 350 Insurance Claim Statistics Vehicle Make and Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Lexus IS 350 4dr 2WD 165 88 186 101 Lexus IS 350 4dr 4WD 200 72 206 Lexus IS 350 Convertible 98 BETTERAVERAGEWORSEEmpty fields indicate not enough data collected

Statistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Lexus IS 350 insurance discounts in Charlotte

Companies that sell car insurance don’t list all available discounts very well, so we researched a few of the more well known as well as the least known credits that you can use to lower your rates. If you don’t get every credit you qualify for, you could be paying more than you need to.

- Organization Discounts – Participating in qualifying employment or professional organizations can get you a small discount on your bill.

- Anti-lock Brakes – Cars with ABS and/or traction control can stop better under adverse conditions so you can save 10 percent or more.

- Own a Home and Save – Owning a home in Charlotte can save a few bucks since home ownership shows financial diligence.

- Senior Discount – Mature drivers can get reduced rates.

- Driver Education Discount – Teen drivers should enroll and complete driver’s education in school or through a local driver safety program.

- Auto/Life Discount – Insurance companies who offer life insurance give a break if you buy a life policy as well.

You can save money using discounts, but most discount credits are not given to all coverage premiums. The majority will only reduce the cost of specific coverages such as collision or personal injury protection. So despite the fact that it appears it’s possible to get free car insurance, nobody gets a free ride. But all discounts should help reduce the cost of your policy.

The example below compares Lexus IS 350 insurance prices with and without discounts. The premiums are based on a female driver, no claims or driving violations, North Carolina state minimum liability limits, comprehensive and collision coverage, and $100 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with safe-driver, marriage, multi-car, claim-free, multi-policy, and homeowner discounts applied.

Some companies that may offer these discounts include:

When comparing rates, check with all companies you are considering which credits you are entitled to. A few discounts might not apply in every state. To choose companies who offer cheap Lexus IS 350 insurance quotes in North Carolina, click here to view.

Car insurance is unique, just like you

When quoting and choosing adequate coverage, there is no perfect coverage plan. Coverage needs to be tailored to your specific needs so this has to be addressed.

For instance, these questions might point out whether or not you would benefit from professional advice.

- Is business equipment covered while in my vehicle?

- How much liability coverage do I need in North Carolina?

- Do I need replacement cost coverage?

- Is my camper covered by my car insurance policy?

- Is pleasure use cheaper than using my Lexus IS 350 to commute?

- When should I not file a claim?

If you can’t answer these questions, you might consider talking to an insurance agent. If you don’t have a local agent, complete this form or go to this page to view a list of companies.

Compare prices but buy from a local Charlotte insurance agent

Some people just prefer to visit with an insurance agent. One of the benefits of comparing rates online is you may find cheaper premium rates and also buy local.

For easy comparison, once you complete this form (opens in new window), your insurance coverage information is submitted to local insurance agents in Charlotte who want to provide quotes for your insurance coverage. It simplifies rate comparisons since you won’t have to search for any insurance agencies since price quotes are sent to the email address you provide. You’ll get the best rates without the usual hassles of price shopping. If you wish to get a comparison quote from a specific insurance company, feel free to search and find their rate quote page and complete a quote there.

For easy comparison, once you complete this form (opens in new window), your insurance coverage information is submitted to local insurance agents in Charlotte who want to provide quotes for your insurance coverage. It simplifies rate comparisons since you won’t have to search for any insurance agencies since price quotes are sent to the email address you provide. You’ll get the best rates without the usual hassles of price shopping. If you wish to get a comparison quote from a specific insurance company, feel free to search and find their rate quote page and complete a quote there.

Picking the best company shouldn’t rely on just a low price. Here are some questions you should ask.

- Will you work with the agent or an assistant?

- What company do they have the most business with?

- Will one accident increase rates?

- Will high miles depreciate repair valuations?

- Do you have coverage for a rental car if your vehicle is in the repair shop?

- Is the agency covered by Errors and Omissions coverage?

- Will the quote change when the policy is issued?

If you want to buy insurance from a reputable insurance agent or broker, you must know there are a couple types of insurance agents to choose from. Agencies in Charlotte are either exclusive or independent (non-exclusive).

Exclusive Insurance Agents

Exclusive agents can only provide pricing for a single company like Allstate, AAA, Farmers Insurance, and State Farm. They usually cannot shop your coverage around so you need to shop around if the rates are high. Exclusive insurance agents receive extensive training on their products and sales techniques which helps them sell on service rather than price. Consumers often use the same agent primarily because of the brand name rather than having the cheapest rates.

The following is a short list of exclusive agencies in Charlotte who can help you get comparison quotes.

- State Farm: Happy Mullen

2201 South Blvd #420 – Charlotte, NC 28203 – (704) 362-0800 – View Map - Joe Pomykacz – State Farm Insurance Agent

2730 E W.T. Harris Blvd #202 – Charlotte, NC 28213 – (704) 535-3700 – View Map - GEICO Insurance Agent

4651 South Blvd Suite B – Charlotte, NC 28209 – (704) 523-2886 – View Map

Independent Insurance Agents

Independent insurance agents are not limited to a single company and that allows them to write policies with any number of different companies depending on which coverage is best. If they find a lower price, they simply move the coverage in-house and that require little work on your part.

When shopping rates, you definitely need to include price quotes from several independent agencies in order to have the best price comparison. They also have the ability to place coverage with lesser-known insurance companies that may have much lower rates than larger companies.

Below are independent insurance agencies in Charlotte that are able to give rate quotes.

- Nationwide Insurance – William Laurie Agency

8820 University E Dr Ste B – Charlotte, NC 28213 – (704) 945-2331 – View Map - Michael A Goodman Insurance Agency Inc

6401 Carmel Rd Ste 208 – Charlotte, NC 28226 – (704) 541-8660 – View Map - Allwood Insurance

3611 Mt Holly-Huntersville Rd #205 – Charlotte, NC 28216 – (704) 395-1239 – View Map

Upon receiving positive responses for all questions you ask and a good coverage price, you may have just found an auto insurance agent that is professional and can service your policy.

Car insurance savings summarized

Cheaper Lexus IS 350 insurance in Charlotte is definitely available online in addition to local insurance agencies, so get free Charlotte auto insurance quotes from both of them in order to have the best price selection to choose from. A few companies may not offer online rate quotes and many times these regional carriers work with independent insurance agents.

When you buy Charlotte auto insurance online, it’s very important that you do not reduce needed coverages to save money. There are many occasions where an accident victim reduced uninsured motorist or liability limits and discovered at claim time they didn’t purchase enough coverage. Your objective should be to buy a smart amount of coverage at an affordable rate.

Much more information about car insurance in North Carolina can be found on the following sites: