Remarkably, a study showed that the vast majority of consumers in North Carolina have remained with the same auto insurance company for a minimum of four years, and 38% of drivers have never shopped around. With the average premium in the United States being $1,847, drivers can save as much as $860 each year by just comparing rate quotes, but they don’t believe the amount of savings they would get if they switched.

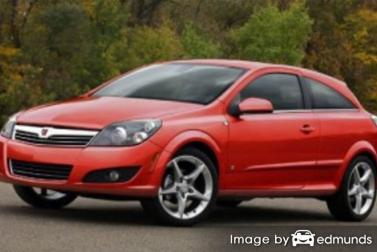

The recommended way to find better pricing on Saturn Astra insurance in Charlotte is to annually compare prices from insurance carriers who sell insurance in North Carolina. Price quotes can be compared by completing these steps.

The recommended way to find better pricing on Saturn Astra insurance in Charlotte is to annually compare prices from insurance carriers who sell insurance in North Carolina. Price quotes can be compared by completing these steps.

- Take a few minutes and learn about how companies price auto insurance and the measures you can control to keep rates down. Many rating criteria that result in higher prices such as traffic tickets, fender benders, and an imperfect credit score can be amended by making minor changes in your lifestyle.

- Compare rates from direct carriers, independent agents, and exclusive agents. Direct companies and exclusive agencies can give quotes from a single company like Progressive or Farmers Insurance, while agents who are independent can give you price quotes for a wide range of companies.

- Compare the new quotes to the price on your current policy to see if a cheaper price is available in Charlotte. If you find better rates and decide to switch, ensure there is no coverage lapse between policies.

One piece of advice is to use the same liability limits and deductibles on each quote and to quote with as many companies as feasibly possible. Doing this provides an accurate price comparison and the most accurate and complete price analysis.

Buying the cheapest car insurance in Charlotte is actually not that difficult if you follow our advice. If you have coverage now, you will most likely be able to buy cheaper car insurance using this strategy. But North Carolina car owners must learn the way companies determine what you pay because rates fluctuate considerably.

Cheapest Saturn insurance prices in Charlotte

The companies shown below have been selected to offer comparison quotes in Charlotte, NC. If you want to find the best cheap auto insurance in NC, it’s highly recommended you get prices from several of them in order to find the cheapest rates.

Discounts mean cheaper rates for Saturn Astra insurance in Charlotte

Companies offering auto insurance do not list every discount they offer very well, so the below list has a few of the more well known as well as the least known ways to save on auto insurance.

- Military Deployment Discount – Being deployed with a military unit can result in better prices.

- Bundled Policy Discount – If you combine your homeowners and auto policies with the same company you may save 10% to 20% off each policy.

- Smart Student Discounts – A discount for being a good student may save as much as 25% on a Charlotte car insurance quote. Most companies allow this discount up until you turn 25.

- College Student – Any of your kids who attend college more than 100 miles from Charlotte and won’t have access to an insured vehicle can receive lower rates.

- Include Life Insurance and Save – If the company offers life insurance, you could get lower rates if you buy a life policy as well.

- Multi-Vehicle Discounts – Buying coverage for multiple cars or trucks with the same company can reduce the rates for all insured vehicles.

- Save over 55 – If you qualify as a senior citizen, you may qualify for reduced rates.

- Passenger Safety Discount – Vehicles equipped with air bags and/or automatic seat belt systems can qualify for discounts of 25 to 30%.

- Pay Upfront and Save – If you can afford to pay the entire bill rather than spreading payments over time you may have a lower total premium amount.

As a sidenote, some credits don’t apply to the entire policy premium. Most only apply to the cost of specific coverages such as liability, collision or medical payments. Even though the math looks like you can get free auto insurance, company stockholders wouldn’t be very happy.

To see a list of insurers that have a full spectrum of discounts in North Carolina, click here.

Insurance can get complicated

When selecting a policy for your personal vehicles, there really is no “perfect” insurance plan. Every insured’s situation is different.

Here are some questions about coverages that might point out whether your personal situation will benefit from professional help.

- What is the ISO rating for a Saturn Astra?

- Is my babysitter covered when using my vehicle?

- What if I don’t agree with a claim settlement offer?

- Should I sign the liability waiver when renting a car?

- Do I pay less if my vehicle is kept in my garage?

- Am I better off with higher deductibles on my Saturn Astra?

- At what point should I drop full coverage?

- What does PIP insurance cover?

If you’re not sure about those questions but one or more may apply to you, you might consider talking to an agent. To find an agent in your area, fill out this quick form.

Buying auto insurance from Charlotte insurance agents

Many drivers would prefer to talk to an insurance agent and that is just fine! A good thing about getting online price quotes is the fact that you can find the lowest rates but still work with a licensed agent.

Once you complete this short form, the coverage information is immediately sent to insurance agents in Charlotte who will gladly provide quotes for your coverage. It simplifies rate comparisons since you won’t have to find an agent on your own as quotes are delivered straight to your inbox. You can find better rates and an insurance agent to talk to. If you want to get a rate quote for a specific company, feel free to jump over to their website and fill out the quote form the provide.

Once you complete this short form, the coverage information is immediately sent to insurance agents in Charlotte who will gladly provide quotes for your coverage. It simplifies rate comparisons since you won’t have to find an agent on your own as quotes are delivered straight to your inbox. You can find better rates and an insurance agent to talk to. If you want to get a rate quote for a specific company, feel free to jump over to their website and fill out the quote form the provide.

Picking an company shouldn’t rely on just the quoted price. These are some valid questions you should ask.

- Do they get extra compensation for selling add-on coverages?

- Who are their largest clients?

- How often do they review coverages?

- Will the agent help in case of a claim?

- Did they already check your driving record and credit reports?

- How long have they worked with personal auto insurance coverage?

- Do you work with a CSR or direct with the agent?

The difference between Charlotte car insurance agents

When searching for a reputable agency, it helps to know the two different agency structures that you can select. Agents in Charlotte are categorized either exclusive or independent agents depending on their company appointments.

Exclusive Insurance Agents

Exclusive agents work for only one company such as State Farm, AAA, Farmers Insurance or Allstate. They generally cannot place coverage with different providers so you might not find the best rates. Exclusive insurance agents are trained well on what they offer and that allows them to sell at a higher price point. Some insured continue to purchase coverage from exclusives primarily because of the brand legacy and the convenience of having a single billing for all their coverages.

Below is a list of exclusive agencies in Charlotte who may provide you with price quote information.

- AAA Carolinas

6600 A A A Dr – Charlotte, NC 28212 – (704) 569-3600 – View Map - Gene Haynes – State Farm Insurance Agent

8316 Medical Plaza Dr a – Charlotte, NC 28262 – (704) 549-1515 – View Map - State Farm: Happy Mullen

2201 South Blvd #420 – Charlotte, NC 28203 – (704) 362-0800 – View Map

Independent Auto Insurance Agencies

Independent agencies often have affiliation with several companies and that gives them the ability to insure with a variety of different insurance companies and find you cheaper rates. If premiums increase, they can switch companies in-house and you won’t have to switch agencies.

When comparing auto insurance rates, we highly recommend that you contact several independent insurance agents to have the most options to choose from. Most also have access to lesser-known insurance companies which could offer lower prices.

Shown below is a list of independent insurance agents in Charlotte who can help you get comparison quotes.

- The Jordan Insurance Agency,LLC

13860 Ballantyne Corporate Pl #120 – Charlotte, NC 28277 – (704) 926-7565 – View Map - Pegram Insurance

4420 C The Plaza – Charlotte, NC 28215 – (704) 563-4343 – View Map - Allwood Insurance

3611 Mt Holly-Huntersville Rd #205 – Charlotte, NC 28216 – (704) 395-1239 – View Map

Don’t give up on affordable rates

As you restructure your insurance plan, you should never skimp on coverage in order to save money. There are many occasions where someone dropped uninsured motorist or liability limits and found out when filing a claim that they should have had better coverage. Your goal should be to purchase a proper amount of coverage at the best possible price, but do not sacrifice coverage to save money.

Consumers leave their current company for a number of reasons such as unfair underwriting practices, being labeled a high risk driver, denial of a claim and even questionable increases in premium. No matter why you want to switch, choosing a new company can be easy and end up saving you some money.

You just learned some good ideas how you can find affordable Saturn Astra insurance in Charlotte. The key concept to understand is the more quotes you get, the better your chances of lowering your prices. Consumers may even find the biggest savings come from the least-expected company.

For more information, feel free to visit the resources below:

- Protect Yourself Against Auto Theft (Insurance Information Institute)

- What Insurance is Cheapest for a Ford Fusion in Charlotte? (FAQ)

- Who Has Affordable Auto Insurance Quotes for Homeowners in Charlotte? (FAQ)

- Who Has the Cheapest Car Insurance Rates for a Jeep Grand Cherokee in Charlotte? (FAQ)

- Who Has the Cheapest Charlotte Car Insurance Rates for a School Permit? (FAQ)

- Who Has Cheap Auto Insurance Rates for Low Mileage Drivers in Charlotte? (FAQ)

- Who Has the Cheapest Auto Insurance for Teachers in Charlotte? (FAQ)

- Child Safety FAQ (iihs.org)

- Five Mistakes to Avoid (Insurance Information Institute)

- Prepare your Teens for Safe Driving (InsureUonline.org)

- A Tree Fell on Your Car: Now What? (Allstate)